REGULATION OF THE MINISTRY OF DIRECTOR GENERAL OF TAXES NUMBER PER – 2/PJ/2024 REGARDING FORM AND PROCEDURES FOR PROVIDING PROOF OF WITHHOLDING INCOME TAX ARTICLE 21 AND/OR ARTICLE 26 AS WELL AS THE FORM, CONTENTS, PROCEDURES FOR COMPLETING, AND PROCEDURES FOR SUBMISSION OF THE INCOME TAX RETURN OF ARTICLE 21 AND/OR ARTICLE 26

In connection with the changes of Income Tax Article 21 calculation method, the Government has issued regulation number PER-02/PJ/2024 on 19 January 2024. This regulation regulates the adjustment of tax forms which previously regulated in PER-14/PJ/2013.

There are changes on 4 (four) of tax forms regulated on PER-02-/PJ/2024 as follows:

- Main section form

- Form section 1721-I

- Form section 1721-II

- Withholding Income Tax Form 1721-VI, 1721-VII, 1721-VIII, 1721-A1

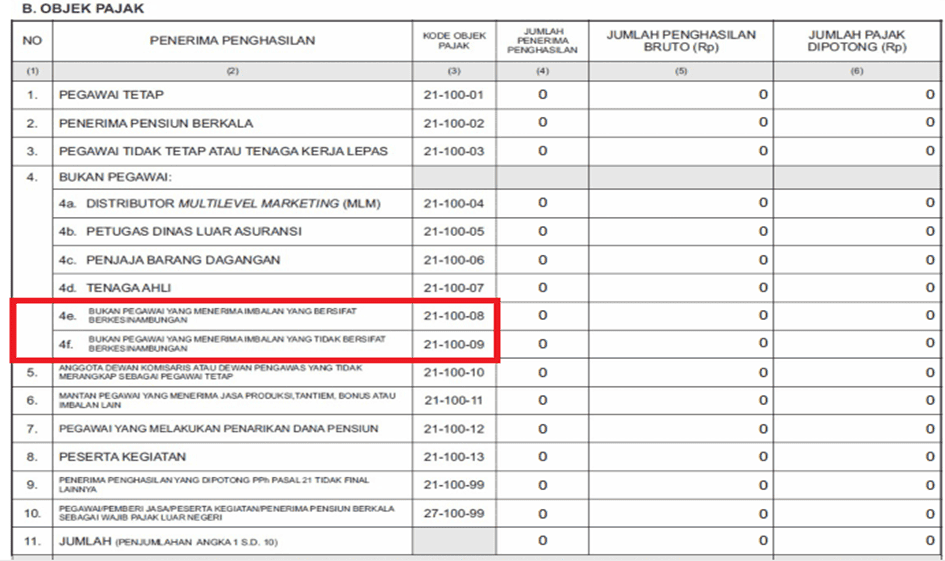

1. MAIN SECTION

PER-14/PJ/2013

PER-02-/PJ/2024

- The column merger of Non-Employee Who Receive Continuous Rewards (Bukan Pegawai Yang Menerima Imbalan Berkesinambungan) and Non-Employee Who Receive Non- Continuous Rewards (Bukan Pegawai Yang Menerima Imbalan Tidak Bersifat Berkesinambungan) into Other Non-Employee (Bukan Pegawai Lainnya).

- The column addition with Description/Keterangan on Overpayment of Income Tax Art.21/26 (Kelebihan Penyetoran PPh Pasal 21 dan/atau Pasal 26) which can be filled with the status of amendment of Tax Return.

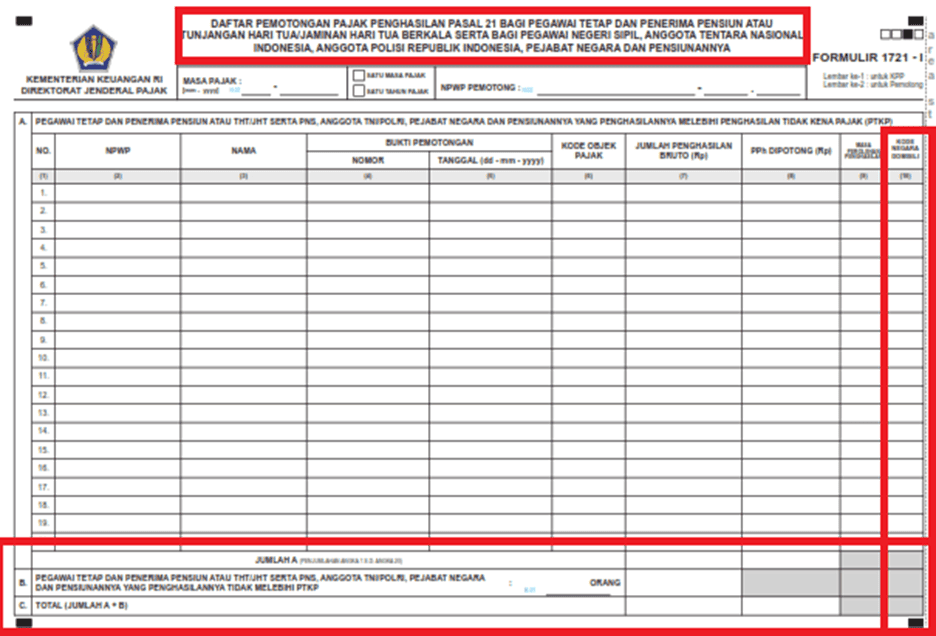

2. FORM SECTION 1721-I

PER-14/PJ/2013

PER-02-/PJ/2024

- Form 1721-1 becomes the list of withholding income tax proof only for Permanent Employee and Retired Employee who Receive Pension Periodically (Pegawai Tetap dan Penerima Pensiun Berkala).

- The Deletion of Gross Income Amount column for Permanent Employee whose Income Under the Non-Taxable Income (Penghasilan Tidak Kena Pajak). Therefore, the list of Employee whose Income Under the Non-Taxable Income must be filled in complete.

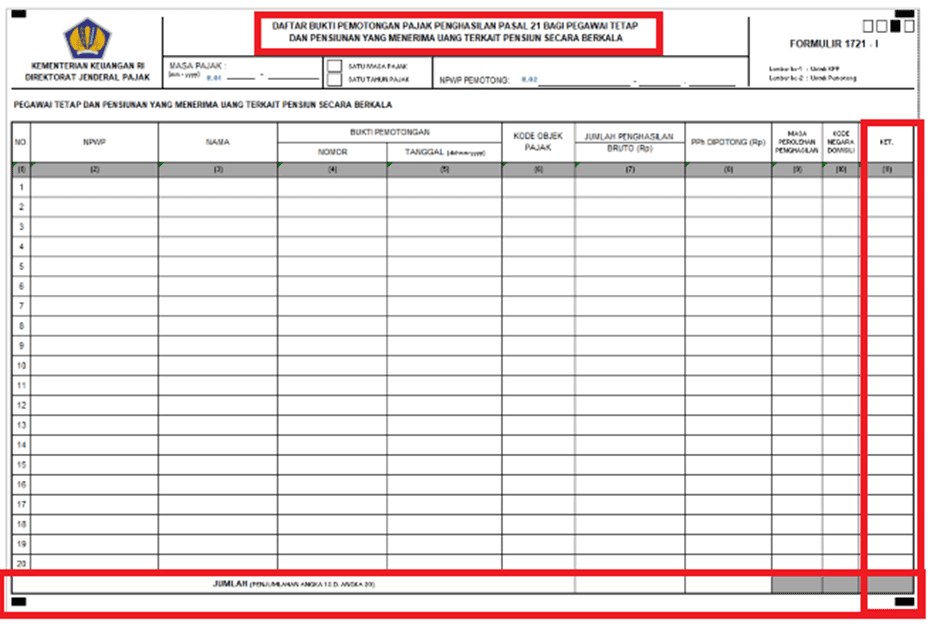

- FORM SECTION 1721-II

PER-14/PJ/2013

PER 02-/PJ/2024

- The changes on name of the form, previously List of Withholding Income Tax Article 21 (Non-Final) and/or Article 26 Proof (Daftar Bukti Pemotongan Pajak Penghasilan Pasal 21 (Tidak Final) dan/atau Pasal 26) to “List of Withholding Income Tax Article 21 Proof which is not Final and/or Income Tax Article 26 (Daftar Bukti Pemotongan Pajak Penghasilan Pasal 21 Yang Tidak Bersifat Final dan/atau Pajak Penghasilan Pasal 26).

- The addition column of information (Keterangan).

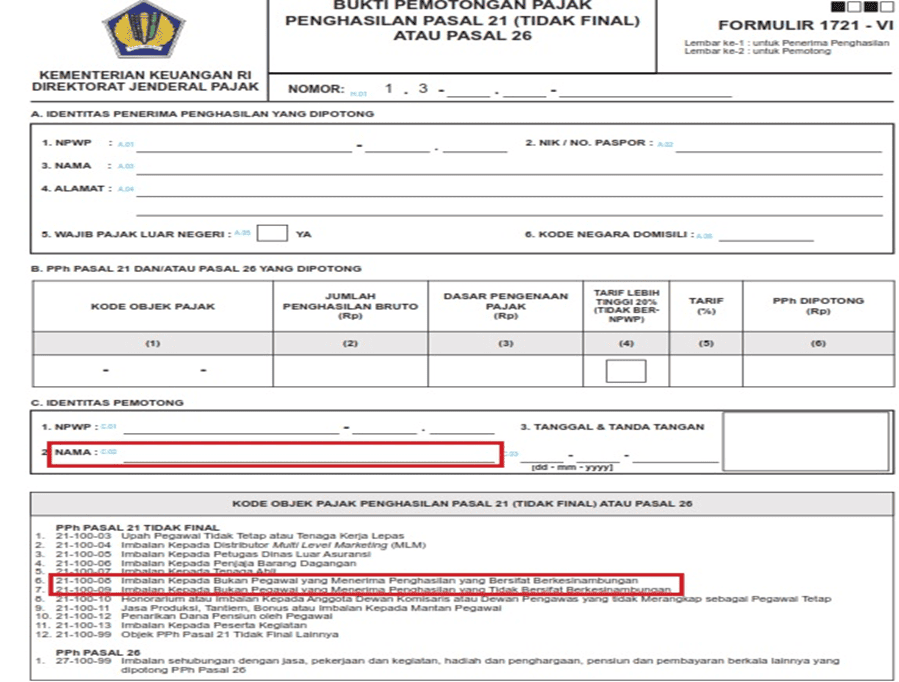

3. PROOF OF WITHHOLDING INCOME TAX

a. Form 1721-VI

PER-14/PJ/2013

PER-02-/PJ/2024

- The addition of the Signatory’s Name (Nama Penandatanganan) on Withholder Identity (Identitas Pemotong).

- The deletion of Tax Object Code 21-100-08 of Non-Continuous Rewards to Non-Employee (Imbalan kepada bukan pegawai yang bersifat tidak berkesinambungan).

- The changes of Tax Object Code 21-100-09 become Rewards to Non-Employee (Imbalan kepada bukan pegawai lainnya).

b. Form 1721-VII

PER-14/PJ/2013

PER-02-/PJ/2024

- The addition of Signatory’s Name (Nama Penandatangan) on Withholder Identity (Identitas Pemotong).

- The deletion of Tax Object Code 21-402-01 of Honoraria and Other Rewards Charged to the APBN or APBD received by Civil Servants, TNI/POLRI Members, State Officials and Retirees (Honor dan Imbalan Lain yang Dibebankan kepada APBN atau APBD yang diterima oleh PNS, Anggota TNI/POLRI, Pejabat Negara dan Pensiunannya).

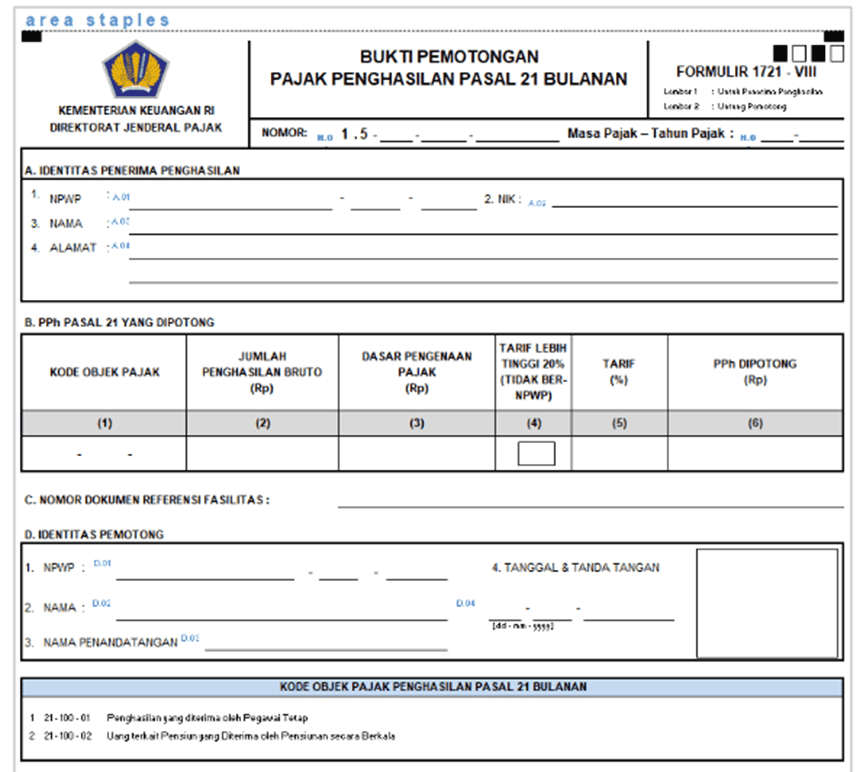

c. Formulir 1721-VIII

PER-02-/PJ/2024

- The addition of the new form “Proof of Monthly Withholding Income Tax Art. 21“ (Bukti Pemotongan Pajak Penghasilan Pasal 21 Bulanan) for the income received by Permanent Employee and pension fund received periodically by the retired employee (Penghasilan yang diterima Pegawai Tetap dan Uang terkait Pensiun yang Diterima Pensiunan secara Berkala). This withholding income tax proof can be given to the employee if asked by employee.

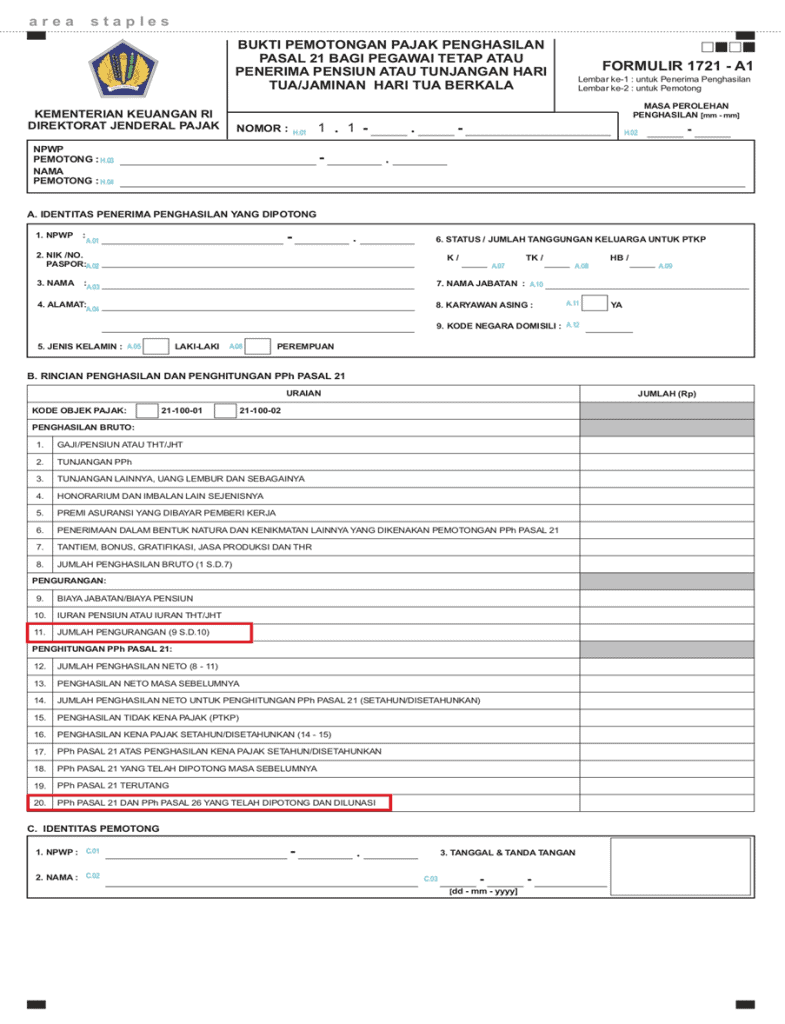

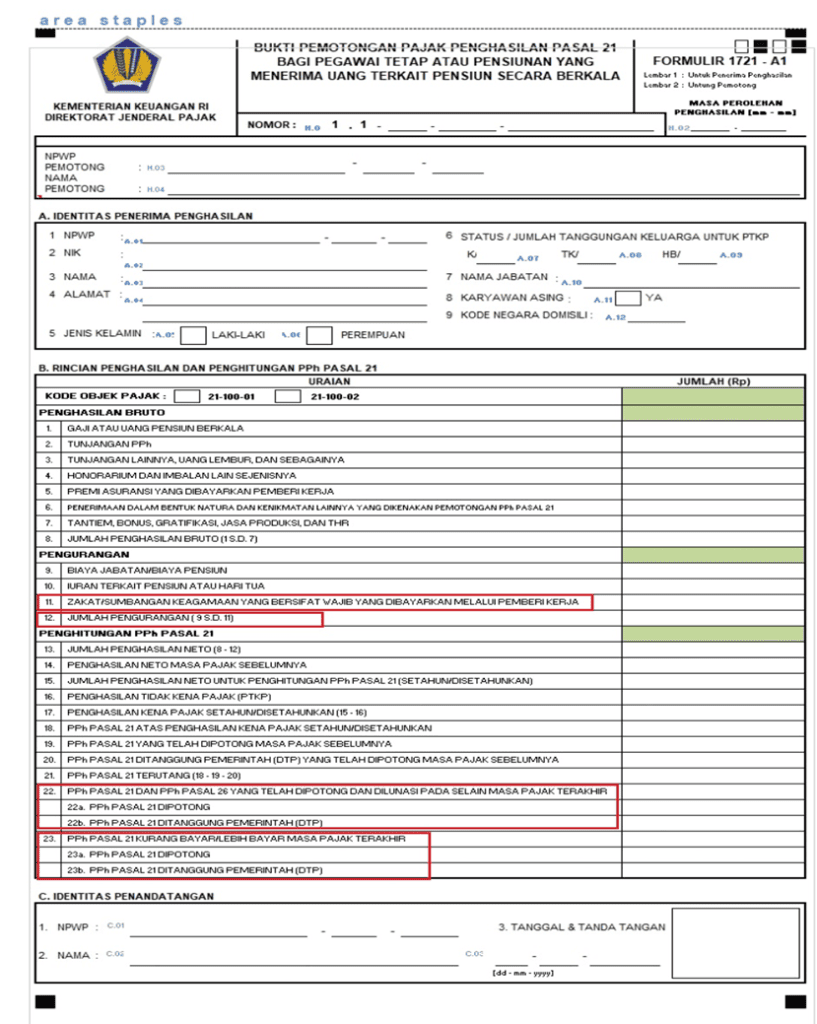

d. Form 1721-A1

PER-14/PJ/2013

PER-02-/PJ/2024

- The addition of component deduction income (number 11) “Zakat/Mandatory Religious Contributions Paid Through the Employer” / “Zakat/Sumbangan/Keagamaan yang bersifat Wajib Yang Dibayarkan Melalui Pemberi Kerja”.

- Addition details of “Income Tax Article 21 and Income Tax Article 26 which have been withheld and paid off in other than the last tax period” / “PPh Pasal 21 dan PPh Pasal 26 yang telah dipotong dan dilunasi pada selain masa pajak terakhir” (detail number 22) and “Income Tax Article 21 Underpayment/Overpayment of the last tax period” / “PPh Pasal 21 Kurang Bayar/Lebih bayar masa pajak terakhir” (detail number 23)

This regulation come into effect in Tax Period of January 2024.

For further tax assistant please contact:

Rani Widianti

T. (+6221) 2222-0200

E. [email protected]

Alvina Octavia

T. (+6221) 2222-0200

E. [email protected]