On 9 January 2026, Announcement Number PENG-2/PJ.09/2026 was issued concerning the implementation of Minister of Finance Regulation Number 112 of 2025 on the Procedures for the Application of Double Taxation Avoidance Agreements.

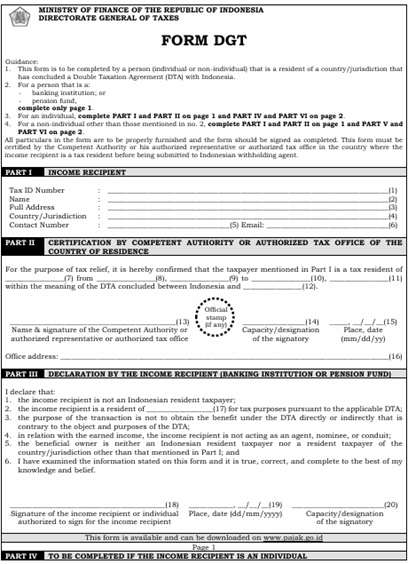

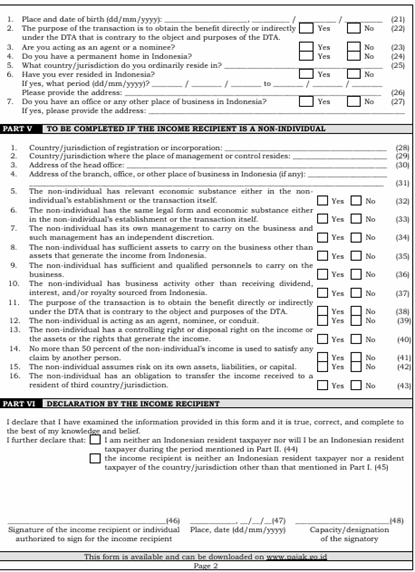

Following the enactment of Minister of Finance Regulation Number 112 of 2025 (PMK-112/2025), it is hereby conveyed that the application of Double Taxation Avoidance Agreements (DTAAs) by Non-Resident Taxpayers shall be carried out using the DGT Form format as stipulated under the Regulation.

Certificates of Domicile for Non-Resident Taxpayers (SKD WPLN) or DGT Forms that still use the format pursuant to Director General of Taxes Regulation Number PER-25/PJ/2018 and were issued prior to the enactment of PMK-112/2025 shall remain valid in accordance with the period specified in the respective documents.

The submission of information in the DGT Form, including its upload, shall continue to be carried out through Menu LA.03-03 – Certificate of Domicile for Non-Resident Taxpayers (SKD WPLN) available in the DJP Coretax system.

Furthermore, pending any adjustments to the format of the Certificate of Domicile for Resident Taxpayers (SKD SPDN) in accordance with the provisions of PMK-112/2025, the SKD SPDN document issued through Menu LA.03-01 in the DJP Coretax system may continue to be used to obtain the benefits of the Double Taxation Avoidance Agreement (DTAA) in the relevant treaty partner country or jurisdiction.

This Announcement is issued in South Jakarta on 9 January 2026.

For Tax Service assistance, please contact:

Rani Widianti

T. (+6221) 2222-0200

Alvina Oktavia

T. (+6221) 2222-0200