GOVERNMENT REGULATION OF THE REPUBLIC OF INDONESIA NUMBER 58 YEAR 2023 CONCERNING INCOME TAX RATE OF WITHHOLDING TAX ARTICLE 21 ON INCOME IN CONNECTION WITH WORK, SERVICES OR ACTIVITIES OF INDIVIDUAL TAXPAYER

This regulation aims to provide convenience and simplicity in fulfilling tax obligations for Taxpayers regarding Withholding Tax Article 21 as well as the adjustment of income tax rates for Domestic Individual Taxpayers in connection with the issuance of Law Number 7 Year 2021 concerning Harmonization of Tax Regulations.

This regulation explains the effective rate of Withholding Tax Article 21 for Individual Taxpayers who receive income in connection with work, services or activities, including state officials, civil servants, members of the Indonesia national army, members of the Republic of Indonesia police, and their retirees consisting of:

- Effective monthly rate

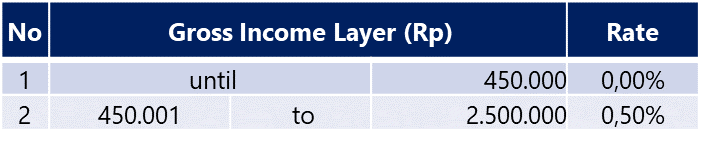

- Effective daily rate

The effective monthly rate is categorized based on the amount of Non-Taxable Income (“Penghasilan Tidak Kena Pajak/PTKP”) according to the marital status and the number of dependents of the Taxpayer at the beginning of the tax year.

There are 3 categories of effective monthly rates as follows:

a. Category A is applied to the monthly gross income received or earned by the income recipients with PTKP status as follows:

- Single without dependents (S/0)

- Single with 1 dependent (S/1)

- Married without dependents (M/0)

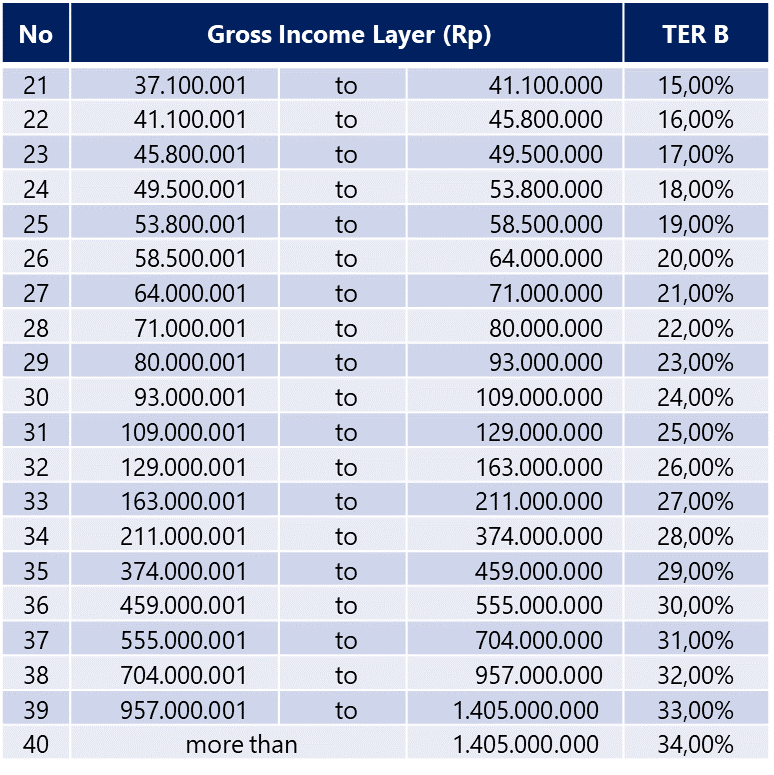

b. Category B is applied to the monthly gross income received or earned by the income recipients with PTKP status:

- Single with 2 dependents (S/2)

- Single with 3 dependents (S/3)

- Married with 1 dependent (M/1)

- Married with 2 dependents (M/2)

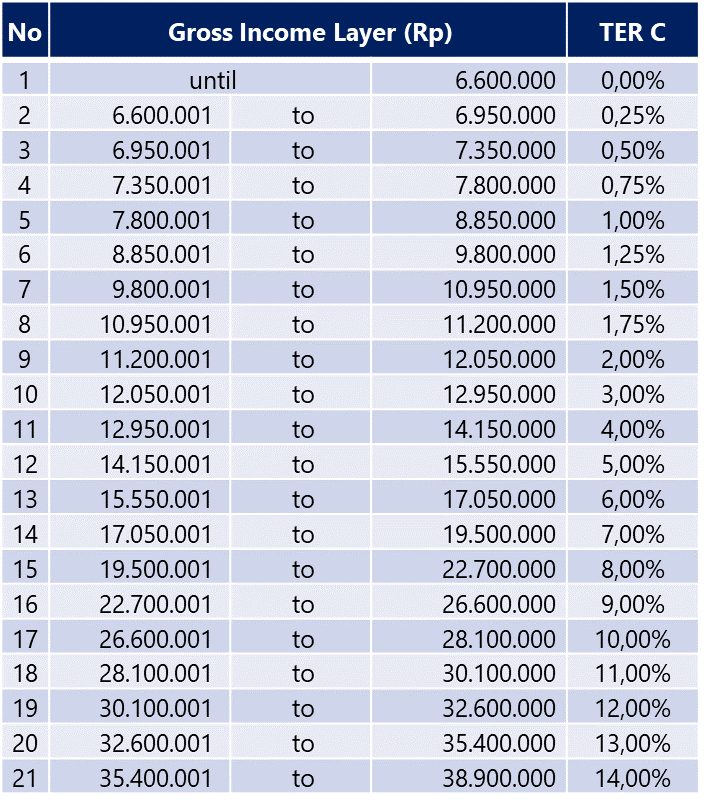

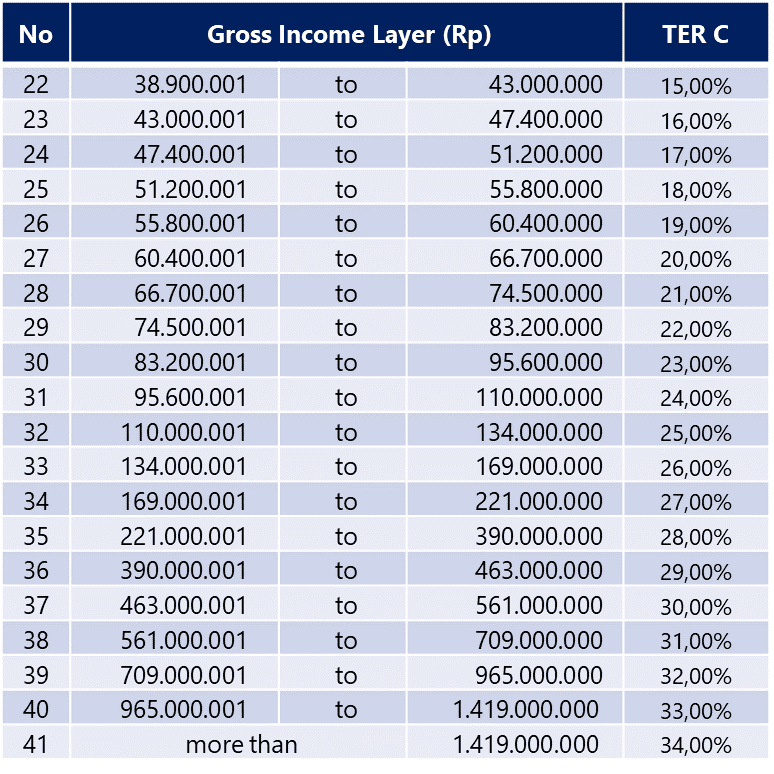

c. Category C is applied to the monthly gross income received or earned by the income recipients with PTKP status Married with 3 dependents (M/3).

The implementation of the effective monthly rate for Permanent Employee is only used in calculating Withholding Tax Article 21 for tax period other than the Last Tax Period. Meanwhile, the calculation of Withholding Tax Article 21 for a year in the Last Tax Period is still using the tax rate on Article 17 paragraph (1) letter a of the Income Tax Law as the current regulation.

This Government Regulation is applied effectively on January 1, 2024.

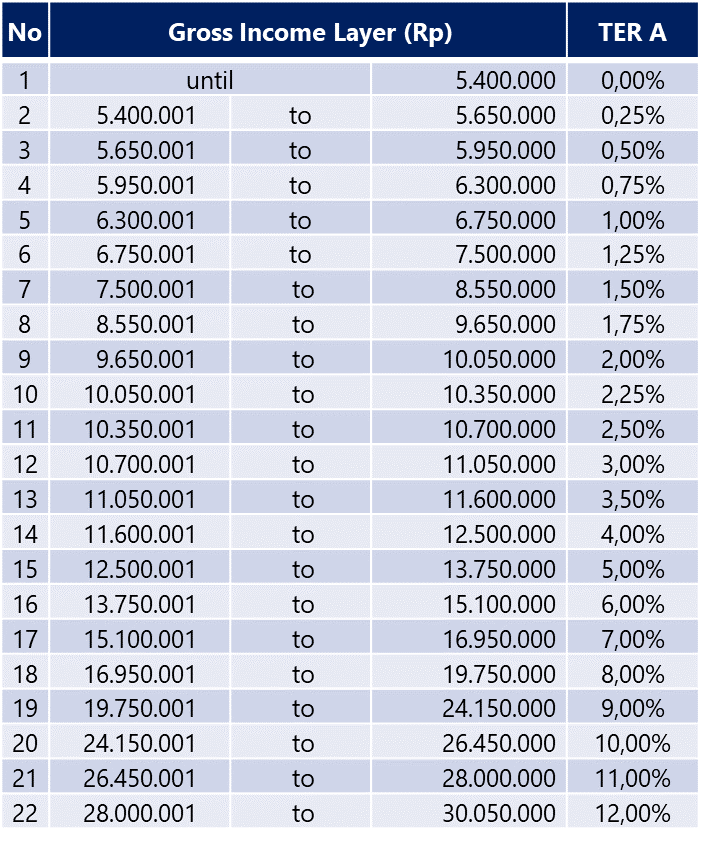

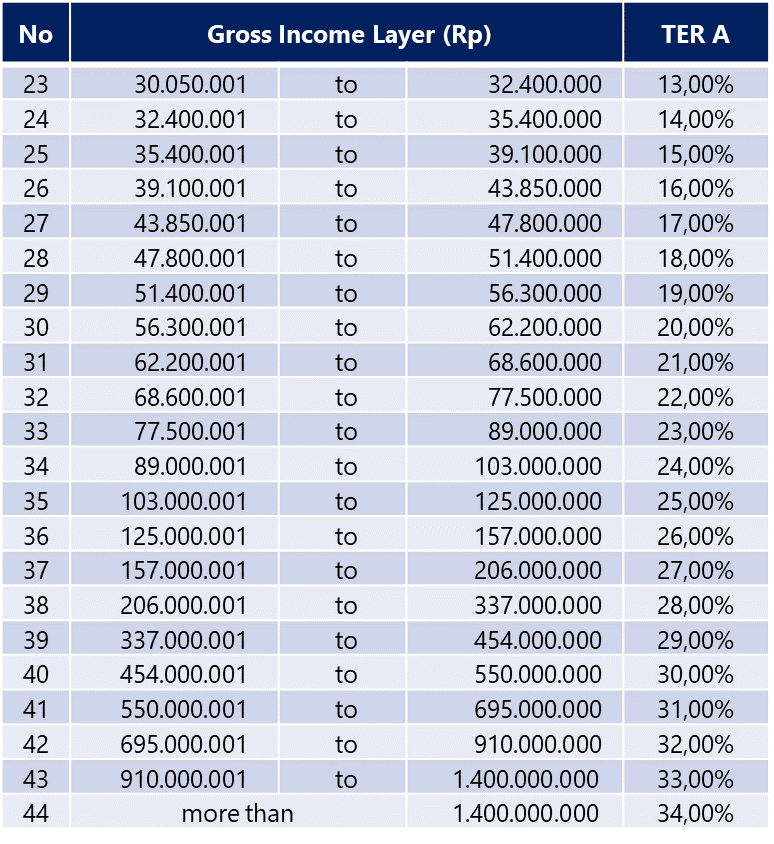

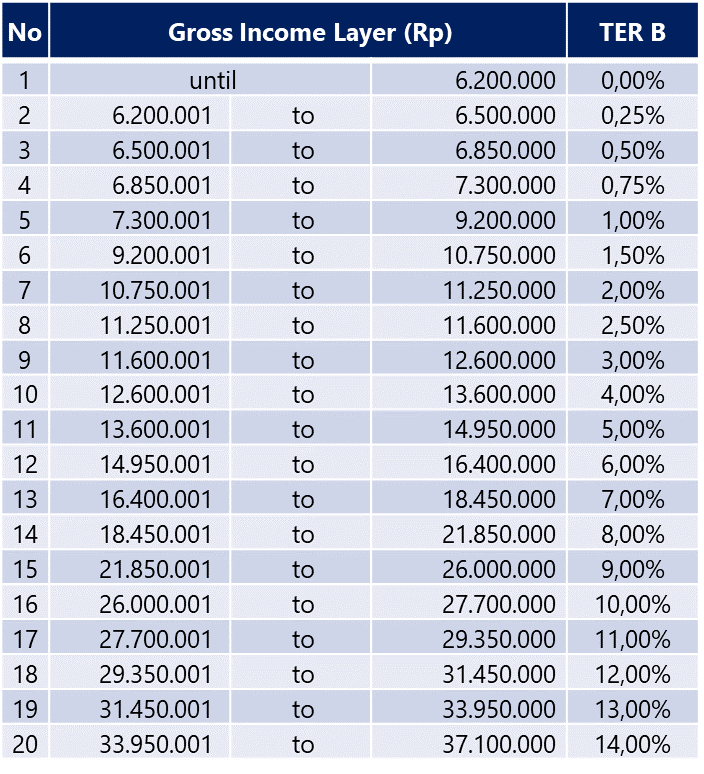

EFFECTIVE MONTHLY RATES CATEGORIES

Effective Monthly Rate Category A

Effective Monthly Rate Category B

Effective Monthly Rate Category C

EFFECTIVE DAILY RATE CATEGORY

For further tax assistant please contact:

Rani Widianti

T. (+6221) 2222-0200

E. rani.widianti@shinewing.id

Alvina Octavia

T. (+6221) 2222-0200

E. alvina.oktavia@shinewing.id