ABSTRACT

Compliance monitoring in the administration of Indonesia’s taxation system is carried out through three tax collection systems: Self-Assessment, Official Assessment, and Withholding Assessment. In the Self-Assessment system, taxpayers independently calculate, pay, and report their taxes, while tax authorities focus on supervision and auditing. Tax audits serve as the primary tool to assess compliance, with objectives such as tax restitutions, late reporting, and fulfillment of tax regulations. The audit process includes issuing audit orders, data requests, and the issuance of Tax Assessment Letters. Tax consultants play a crucial role in assisting taxpayers during audits to ensure compliance with applicable regulations.

Indonesia implements three types of tax collection systems, which are the Self-Assessment System, Official Assessment System, and Withholding Assessment System. The taxes under the Self-Assessment System include Income Tax Articles 17, 28, 29, 31e, and 25. The taxes under the Official Assessment System include Land and Building Tax and other regional taxes. Meanwhile, the taxes under the Withholding Assessment System include Income Tax Articles 15, 21, 22, 23, 26, Final Income Tax Article 4 paragraph (2), and Value-Added Tax (VAT).

The Self-Assessment System means that the determination of the amount of tax payable is carried out independently by the taxpayer. Tax administration activities such as calculating, paying, and reporting tax payments are actively carried out by taxpayers. The taxpayer will come to the Tax Office or responsibly input through the Core Tax Administration System (CTAS) implemented as of January 1, 2025.

With the active role of taxpayers, the function of the tax collector is only to supervise, examine, and monitor compliance with the implementation of the tax administration system executed by taxpayers. The role of supervision is crucial because the weakness of this system lies in the full trust placed in the taxpayer. It is not uncommon for taxpayers to pay less tax than required. One of the most frequently used methods in monitoring compliance with the implementation of the tax administration system is Tax Audit.

Based on Article 1 of Government Regulation Number 50 Year 2022, audit is a series of activities to collect and process data, information, and/or evidence conducted objectively and professionally based on audit standards. The purpose of a tax audit includes testing compliance with tax obligations, which covers:

- Tax restitution in case of an overpayment Tax Return, including preliminary refunds;

- Tax returns filed in a loss condition;

- Late filed tax returns exceeding the warning letter period;

- Follow-up on unresolved SP2DK cases;

- Taxpayers conducting merger, consolidation, expansion, closure/liquidation, dissolution; and

- Taxpayers leaving Indonesia permanently.

Meanwhile, other purposes of the tax audit to enforce tax regulations include:

- Elimination of Tax ID Number;

- Issuance of Tax ID Number by authority;

- Appointment of taxable entrepreneurs by authority;

- Revocation of taxable entrepreneurs;

- Determination of taxpayers in remote areas;

- Determining when production starts or extending the period of loss compensation related to the provision of tax facilities;

- Fulfilling requests for information from partner countries under Double Taxation Avoidance Agreements (DTAAs);

- Matching data and/or information tools;

- Determination of one or more places where Value Added Tax (VAT) is payable;

- Data collection in terms of the preparation of net income calculation norm; and

- Follow-up of data matching and/or information tools.

The types of tax audit are divided into two, which are Field Audit and Office Audit. Field Audit is an audit conducted at the location of the taxpayer’s domicile, place of business activity or freelance activity of the taxpayer, and/or other places deemed necessary by the tax auditor. Office Audit is an audit conducted on taxpayers at the Tax Audit Implementation Unit office covering one specific type of tax in the current year and or previous years carried out with a simple audit.

| Audit Type | Audit Purpose | |

| Compliance Testing Audit | Other Purpose Audit | |

| Office Audit | 4 months + a maximum of 2 months extension* | 14 days |

| Field Audit | 6 months + a maximum of 2 months extension* | 4 months |

*) Except for office audit on concrete data, it cannot be extended.

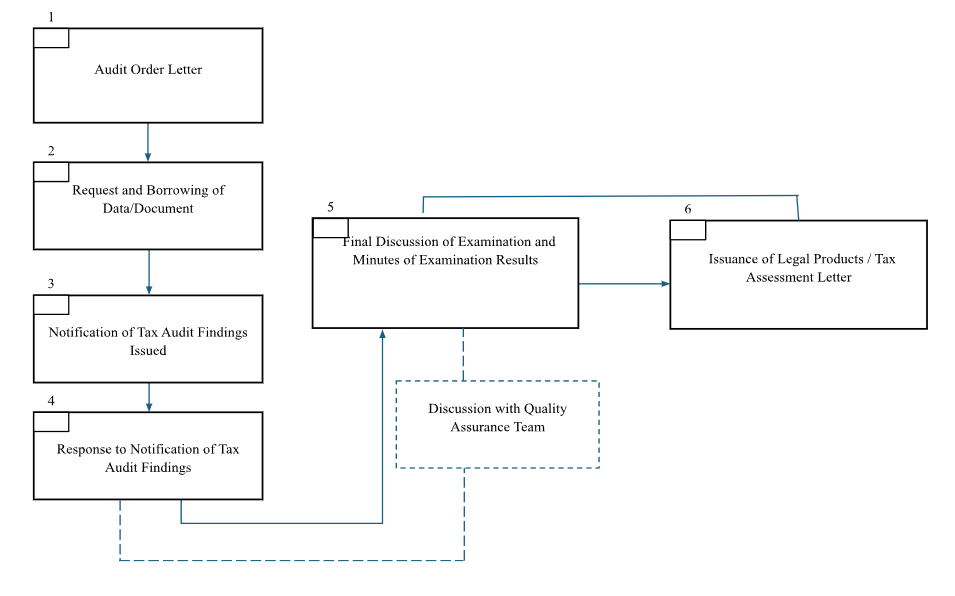

Flow of Tax Audit in Indonesia:

- Audit Order Letter

According to Article 11 of Ministry of Finance Regulation No. 184/PMK.03/2015, which is an amendment to MoF Regulation No. 17/PMK.03/2013, states that the tax auditor is required to submit a Field Audit Notification Letter to the taxpayer when the audit is conducted with the type of Field Audit or Call Letter in the context of Office Audit to the taxpayer when the audit is conducted with the type of Office Audit.

- Request and Borrowing of Data/Document

Tax auditor has the authority to view and/or borrow books, records, and/or documents that form the basis of bookkeeping or recording, and other documents related to the taxpayer’s income, business activities, freelance work, or taxable objects and to access electronically managed data as per Article 12, paragraph (1) of the same MoF Regulation.

- Notification of Tax Audit Findings

Notification of Tax Audit Findings is a letter containing the audit findings which include corrected items, correction value, basis for correction, temporary calculation of the principal tax owed and temporary calculation of administrative penalties. The tax auditor is obliged to issue Notification of Tax Audit Findings and submit it to the taxpayer to be responded by the taxpayer.

- Response to Notification of Tax Audit Findings

Taxpayers who have received the Notification of Tax Audit Findings can respond to the tax audit within 7 days. If additional time is needed to submit the response, taxpayers may request an extension from the tax office. If the tax auditor approves the request, an additional 3 days will be granted to response to the Notification of Tax Audit Findings.

- Final Audit Discussion and Audit Report

According to Article 1 No. 16 of Ministry of Finance Regulation No. 184/PMK.03/2015, which is an amendment to MoF Regulation No. 17/PMK.03/2013, the Final Discussion of Audit Results is a discussion between the taxpayer and the tax auditor on the audit findings, the results of which are stated in the minutes of discussion and minutes of the final discussion of the audit results signed by both parties and contain corrections to the principal tax payable both agreed and disagreed and the calculation of administrative penalties.

Furthermore, the taxpayer may submit a request for discussion with the Quality Assurance (QA) Team 3 days after the audit minutes are signed by the taxpayer, in which the taxpayer has disagreement with the audit result. The discussion with the QA Team is limited to the legal basis of the correction that has not been agreed upon.

After the taxpayer and the tax auditor conduct the final discussion of the audit, the tax auditor will make the results of the discussion of the audit as stated in the Minutes of the Final Hearing signed by both parties and contains the correction of the principal tax payable both agreed and disagreed and the calculation of administrative penalties. For the Final Discussion, the taxpayer is obliged to attend the Final Discussion of Audit Results which has been regulated in Article 43 of the relevant MoF Regulation.

- Issuance of Legal Products / Tax Assessment Letter

After the signing of the Minutes by the tax auditor team and the taxpayer, the output is the issuance of a Legal Product in the form of a Tax Assessment Letter. This is in accordance with the minutes of discussion and statement of approval of the audit results and the Minutes of Final Discussion of Audit Results attached with a summary of the results of the final discussion, signed by the tax audit team and the taxpayer, representative, or attorney of the taxpayer.

The Role of Tax Consultants in Audits

A tax consultant is a licensed practitioner who provides tax consultation services to taxpayers for fulfilling their tax obligations and obtaining their rights under applicable law. In tax audit process, a registered tax consultant can represent the taxpayer, interact with the tax auditor, provide explanations and/or responses, and mediate between the taxpayer and the examiner in the tax audit process.

In addition, tax consultants also play a role in assisting taxpayers in compiling the data required by the tax auditor in the form of books, records and documents, and helping to bring together the middle point between taxpayers and the tax auditor, ensuring that the audit process can run smoothly in accordance with applicable tax regulations. Each year, tax consultants from SW Indonesia help clients for assistance in the tax audit process. Both assisting in tax audits for restitution purposes, as well as tax audits in the case of monitoring compliance with the implementation of the tax administration system.