The government provides tax incentives in the form of Tax Holiday and Tax Allowance to Corporate Taxpayers (“Corporate Taxpayers”) with the aim of promoting investment activities, economic growth, and competitiveness. Additionally, tax incentives are intended to support commercial production preparation and protect domestic business activities, particularly the domestic industries.

Tax Holiday Facility is provided to Corporate Taxpayers in the form of reduction of Corporate Income Tax (CIT), as regulated in the Ministry of Finance Regulation (PMK) of the Republic of Indonesia Number 130/PMK 010/2020 amending PMK Number 150/PMK.010/2018 regarding the Granting of Corporate Income Tax Reduction Facility.

General Criteria:

- Being a pioneer industry;

- Having legal status in Indonesia;

- Engaging in new investment that has not been previously approved:

- decision on granting or notification of refusal of corporate income tax reduction;

- decision on granting or notification of refusal of corporate income tax reduction;

- decision on granting or notification of refusal of corporate income tax reduction;

- decision on granting or notification of refusal of corporate income tax reduction;

- Having a minimum planned new investment value of at least IDR 100 billion;

- Complying with the provisions regarding the ratio between debt and equity as referred to in the Minister of Finance Regulation on determining the ratio between debt and equity of companies for Corporate Income Tax calculation purposes; and

- Committing to commence the realization of the new investment plan no later than 1 year after the issuance of the decision on corporate income tax reduction.

Pioneer Industry refers to an industry with broad connections, high value added and externalities, introducing new technology, and having strategic value to the national economy. Here are 18 pioneer industries that are eligible for the tax holiday facility:

- Primary metal industry:

- iron and steel; or

- non-iron and steel,

- Refining or processing of oil and natural gas with or without integrated derivatives;

- Basic organic chemical industry derived from oil, natural gas, and/or coal with or without integrated derivatives;

- Basic organic chemical industry derived from agricultural, plantation, or forestry products with or without integrated derivatives;

- Basic inorganic chemical industry with or without integrated derivatives;

- Major raw material industry for pharmaceuticals with or without integrated derivatives;

- Manufacturing of irradiation, electromedical, or electrotherapy equipment;

- Manufacturing of main components for electronic or telematic equipment;

- Manufacturing of machinery and main machinery components;

- Manufacturing of robotic components supporting the manufacturing of manufacturing machines;

- Manufacturing of main components for power generating machinery;

- Manufacturing of motor vehicles and main motor vehicle components;

- Manufacturing of main components for ships;

- Manufacturing of main components for trains;

- Manufacturing of main components for aircraft and aerospace industry supporting activities;

- Processing industry based on agricultural, plantation, or forestry products producing paper pulp or its derivatives with or without integrated derivatives;

- Economic infrastructure; or

- Digital economy including data processing, hosting, and related activities.

The reduction of Corporate Income Tax (CIT) as referred to is granted as follows:

- 100% of the owed CIT amount for new investments with a minimum value of at least IDR 500 billion;

- 50% of the owed CIT amount for new investments with a minimum value of at least IDR 100 billion and less than IDR 500 billion.

Rates and Duration of CIT Reduction:

- 100% of the owed CIT amount:

- 5 years for new investments with a value of at least IDR 500 billion and less than IDR 1 trillion;

- 7 years for new investments with a value of at least IDR 1 trillion and less than IDR 5 trillion;

- 10 years for new investments with a value of at least IDR 5 trillion and less than IDR 15 trillion;

- 15 years for new investments with a value of at least IDR 15 trillion and less than IDR 30 trillion; or

- 20 years for new investments with a value of at least IDR 30 trillion.

After the aforementioned CIT reduction period, Corporate Taxpayers are eligible for a 50% reduction of the owed CIT for the following 2 tax years.

- 50% of the owed CIT amount:

5 years for new investments with a value of at least IDR 100 billion and less than IDR 500 billion. After the period of CIT reduction, Corporate Taxpayers are eligible for a 25% reduction of the owed CIT for the following 2 tax years.

Taxpayers can apply for these incentives online through the OSS (Online Single Submission) system.

TAX ALLOWANCE

In accordance with the Government Regulation of the Republic of Indonesia Number 78 of 2019, which has been amended from the previous regulations Government Regulation Number 9 of 2016 and Government Regulation Number 18 of 2015 on Corporate Income Tax Facilities for Investment in Specific Business Fields and/or Specific Regions.

The Corporate Income Tax facilities include:

- A reduction of net income by 30% of the amount of investment in tangible fixed assets, including land, used for the Main Business Activities, for 6 (six) years with an annual reduction rate of 5%;

- Accelerated depreciation of tangible fixed assets and accelerated amortization of intangible assets acquired as part of the Investment (with a useful life 50% lower than the normal useful life and a depreciation rate twice the normal rate);

- Imposition of a 10% Corporate Income Tax on dividends paid to foreign taxpayers other than permanent establishments in Indonesia, or a lower rate based on applicable double taxation avoidance agreements;

- Compensation of losses longer than 5 years but not exceeding 10 years.

There are 166 business sectors that can receive tax allowance, an expansion from the previous regulation covering 145 segments.

Agriculture

- Cattle farming (meat and dairy)

- Cultivation of corn, soybeans, tropical fruits, sugarcane, pepper

- Rice, soybean cultivation, ornamental plants, beverage crops, spices

- Fishery

Forestry

- Management of Teak, Pine, Mahogany, Sonokeling, Sengon, Sandalwood, Acacia, Eucalyptus Forests

Energy

- Coal Gasification

- Geothermal Energy Utilization

- Metal Ore Mining

- Power Generation

- Geothermal

- Alternative/Renewable Energy

Oil and Gas Industry

- Oil Refining

- Liquefied Natural & Petroleum Gas

- Lubricants

Manufacturing Industry

- Food

- Iron and Steel

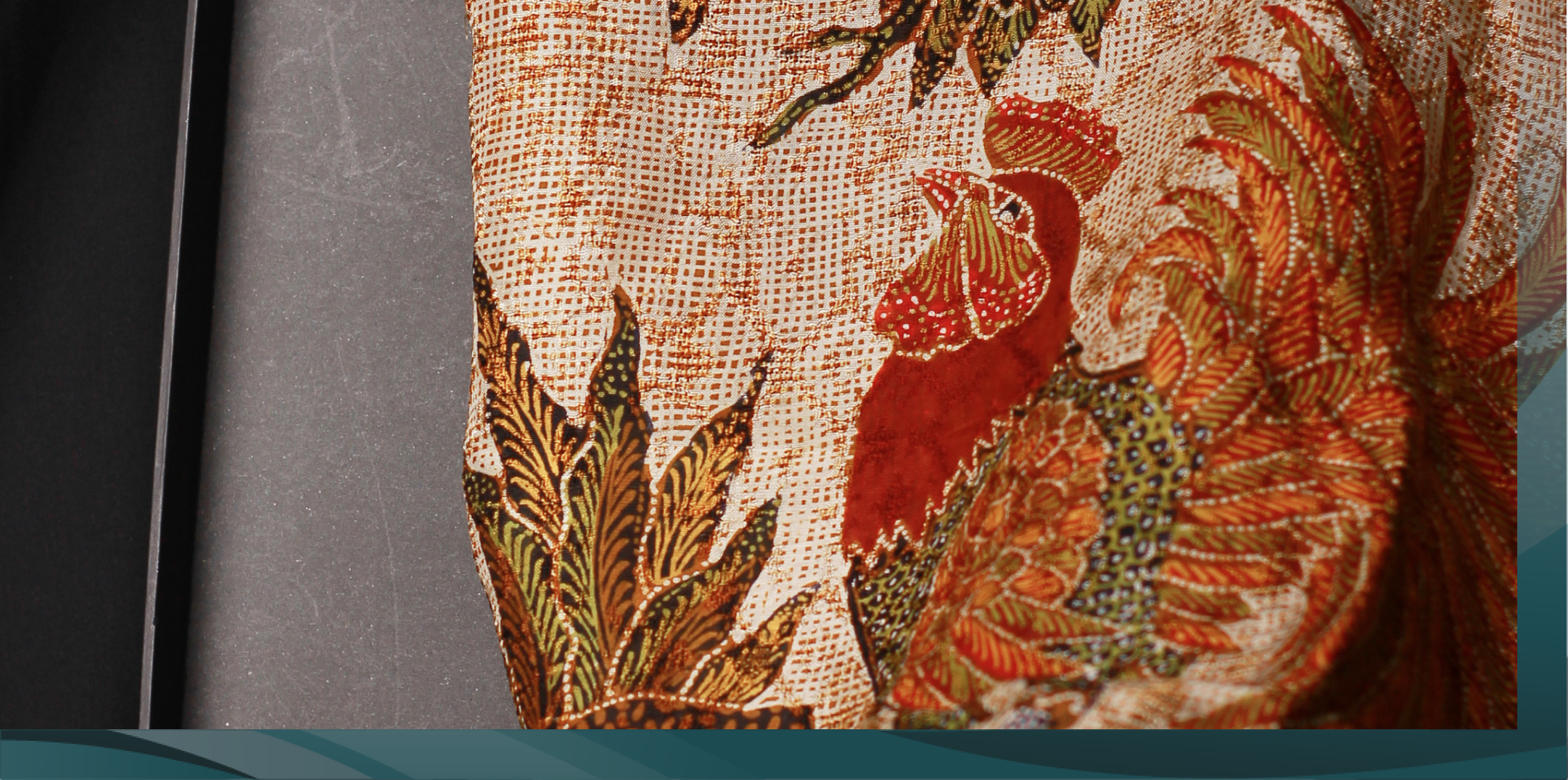

- Clothing

- Textile

- Semiconductors

- Computers, Electronic Devices, and Optics

- Communication Devices

- Television

- Tires

- Pharmaceuticals

- Cosmetics

- Processed Fish and Shrimp

- Chemicals

- Leather and Footwear

- Non-metallic minerals (e.g., glass)

- Electrical Equipment

- Machinery and Equipment

- Electrical Equipment

- Transportation Equipment

- Water Management

- Etc

However, this does not preclude the possibility that, under certain conditions and considerations, the government may revoke these facilities from Corporate Taxpayers. For example, in the Nickel Industry (NPI & Ferronickel Smelters), the government plans to revoke the Tax Holiday facility for nickel industry with low content. For companies that apply for new permits to build pig iron and ferronickel smelters, if the capacity of pig iron and ferronickel smelters is already substantial and a significant amount of investment has been made, both types of nickel can no longer be categorized as pioneer industries. However, for Nickel industry players who have previously obtained the Tax Holiday facility, they can continue to enjoy the facility without revocation by the Government.

EXPORT REVENUE

Tax incentives are also provided by the Indonesian Government to optimize the utilization of Natural Resources (NR) and accelerate NR down streaming. One such measure is through the issuance of Government Regulation (PP) Number 36 of 2023 concerning Foreign Exchange from Export Activities of Resource Utilization, Management, and/or Processing Activities (PP NR Export), as a revision of PP Number 1 of 2019.

PP Number 36 of 2023 is designed to maintain national economic sustainability and resilience. Its aim is to promote financing sources for economic development, boost investment, and enhance NR export performance. PP Number 36 of 2023 requires exporters to channel foreign exchange from NR export activities into Indonesia’s financial system. Tax incentive provisions accompany this obligation.

Articles 5, 6, and 7 of PP No. 36/2023 reaffirm the obligation of exporters who have foreign exchange earnings (FEE) from natural resource (NR) exports with export values in the Export Customs Notification (PPE) of at least USD 250,000 or equivalent, to channel FEE from NR into Indonesia’s financial system. This is done by placing FEE from NR into a special NR export account at Indonesian export financing institutions and/or banks that conduct foreign currency business activities.

FEE from NR that exporters have placed in the aforementioned special NR export account must be kept in Indonesia’s financial system for at least 30 percent for a minimum of three months from the date of placement in the special NR export account.

The table of incentives for Corporate Income Tax (CIT) on interest from NR export deposit is presented below: CIT with Incentive Tenor USD Converted to Rupiah 1 Month 10% 7.5% 3 Months 7.5% 5% 6 Months 2.5% 0%

6 Months 0% 0%